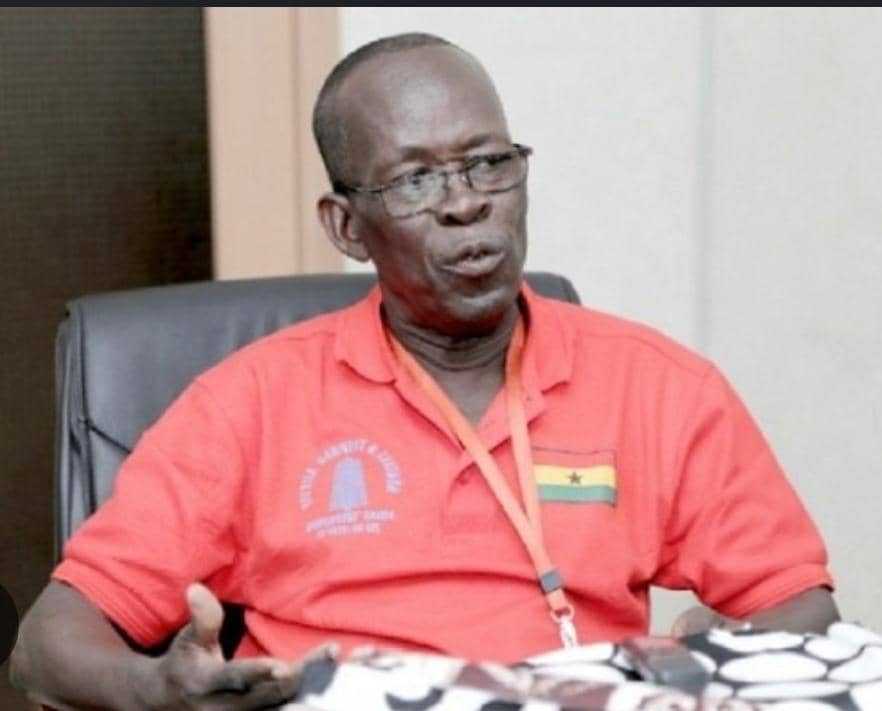

Advertisement

The

General

Secretary

of

the

Ghana

Federation

of

Labor,

Abraham

Koomson,

has

strongly

opposed

the

proposed

sale

of

SSNIT

hotels,

citing

findings

from

the

SSNIT

Transaction

Advisory

report.

According

to

him,

the

SSNIT

Transaction

Advisory

report

reveals

that

the

Rock

City

Hotel’s

(RCH)

funds

are

insufficient

to

purchase

the

shares

in

question,

thus

further

disqualifying

the

sale.

“So

why

are

they

not

making

profit?

If

you

read

the

SSNIT

Transaction

Advisory

report,

Rock

City

Hotel’s

funds

are

not

enough

to

purchase

the

shares

being

talked

about.

The

SSNIT

Transaction

Advisory

report

disqualifies

the

sale,”

Koomson

told

Nana

Yaa

Brefo

on

Onua

FM,

July

9.

He

explained

that

according

to

the

report,

while

the

financial

due

diligence

on

RCH

was

generally

satisfactory,

it

highlighted

significant

concerns

regarding

the

financial

capacity

of

RCH

given

the

transaction’s

size.

Koomson

The

current

proposal

does

not

demonstrate

the

financial

strength

to

meet

the

semi-annual

payments

of

$7.8

million,

as

RCH’s

projected

revenues

for

2024

fall

short

of

this

requirement.

Therefore,

RCH

has

not

met

the

financial

due

diligence

requirements

to

undertake

the

deal

in

its

current

form.

Koomson’s

statements

come

amidst

ongoing

discussions

about

the

future

of

these

properties.

According

to

the

General

Secretary,

the

primary

motivation

for

selling

the

hotels

appears

to

be

their

lack

of

profitability

and

for

this,

he

argues

that

there

should

be

a

prompt

change

in

management

rather

than

a

sale.

“Are

they

saying

hotel

businesses

are

not

good?

You’re

saying

the

SSNIT

hotels

are

not

making

money,

so

I

compared

and

analyzed

to

find

out

if

it’s

a

management

issue.

Then

they

should

remove

the

current

Management

because

hotel

business

is

not

bad,

especially

with

where

these

SSNIT

hotels

are

located,”

he

said.

Koomson’s

comments

suggest

a

need

for

a

thorough

review

of

the

management

practices

rather

than

divesting

the

properties.

Summary

of

the

report

The

issues

making

the

offer

unacceptable,

according

to

the

General

Secretary

of

GFL,

is

the

Extended

Payment

Period.

The

proposed

two-year

payment

plan

introduces

a

prolonged

period

of

uncertainty

during

which

SSNIT’s

strategic

objectives

will

be

on

hold.

The

second

is

the

Unequal

Bidding

Terms

which

suggests

that

other

bidders

did

not

have

the

option

to

spread

the

payment

over

two

years,

which

creates

an

uneven

playing

field.

Third,

Public

Scrutiny,

A

two-year

transition

period

could

subject

the

transaction

to

extensive

public

scrutiny,

potentially

impacting

its

success.

Forth,

Unconfirmed

Funding

Sources

which

suggest

the

proposal

lacks

a

clear

indication

of

the

source

of

funds

for

the

balance

of

the

acquisition

price,

raising

concerns

about

RCH’s

ability

to

complete

the

purchase.

Fifth,

No

Bank

Guarantee:

The

absence

of

a

bank

guarantee

in

the

latest

proposal

fails

to

provide

SSNIT

with

the

necessary

financial

security.

Sixth,

Non-Aligned

Objectives:

The

proposal

does

not

meet

SSNIT’s

objective

of

selecting

a

strategic

partner

with

the

required

expertise

and

financial

strength

to

turn

around

the

fortunes

of

the

hotels.

SSNIT

aims

to

limit

its

equity

holdings

to

26%-49%,

which

is

not

addressed

in

the

current

proposal.

Seventh,

Lack

of

Immediate

Full

Payment:

SSNIT

prefers

a

cash

transaction

with

full

payment

in

exchange

for

the

shares

and

management

control,

which

the

current

proposal

does

not

fulfill.

Eighth,

CAPEX

Commitment:

The

CAPEX

funding

plan,

which

includes

a

60/40

ratio

contribution

by

RCH

and

SSNIT,

may

add

financial

strain

and

complexity.

Ninth,

Inadequate

Financial

Capacity:

Financial

due

diligence

indicates

that

RCH’s

financials

cannot

support

the

semi-annual

payment

requirement.

RCH’s

projected

revenue

for

2024

is

insufficient

to

meet

the

installment

payments,

and

the

company

lacks

the

necessary

cash

reserves.

RECOMMENDATIONS

BY

THE

SSNIT

TRANSACTION

ADVISORY

TEAM

1.

Insist

on

Full

Payment:

SSNIT

should

require

full

payment

upfront

to

minimize

financial

risk

and

ensure

immediate

transaction

closure.

2.

Fallback

Option:

If

RCH

cannot

make

full

payment,

SSNIT

can

offer

RCH

the

option

to

purchase

only

one

lot

with

100%

payment

of

the

agreed

price.

RCH

can

negotiate

an

option

to

buy

the

second

lot

with

a

fixed

expiry

date

for

the

option.

3.

Bank

Guarantee:

RCH

should

be

required

to

provide

a

bank

guarantee

to

assure

SSNIT

of

their

financial

capability

to

complete

the

transaction.

4.

Revised

Term

Sheet:

SSNIT

should

attach

a

revised

term

sheet

template

backed

by

a

bank

to

clarify

the

required

financial

information

and

guarantee

terms

that

RCH

must

provide.